[vc_row][vc_column][kswr_spacer spc_desk_height=”60″ spc_tablet_height=”60″ spc_tablet_sm_height=”60″ spc_phone_height=”60″ spc_phone_sm_height=”60″][ultimate_heading main_heading=”What is an Order to Cash Cycle?” main_heading_font_family=”font_family:Montserrat|font_call:Montserrat|variant:700″ main_heading_style=”font-weight:700;” main_heading_font_size=”desktop:36px;” margin_design_tab_text=””][/ultimate_heading][kswr_spacer spc_desk_height=”30″ spc_tablet_height=”30″ spc_tablet_sm_height=”30″ spc_phone_height=”30″ spc_phone_sm_height=”30″][vc_column_text]

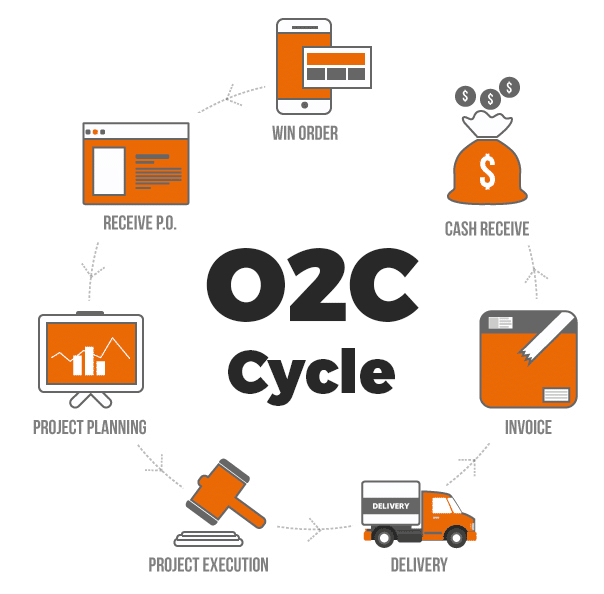

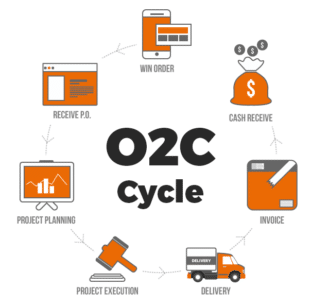

The first stage of order to cash is the order itself. The customer places an order with the firm that specifies the work that the customer wants the firm to undertake and the terms of payment. The order represents the fact that the manufacturing firm and the customer have agreed to a contractual relationship and that it is now up to the firm to begin work.

The next step is the actual manufacturing procedure. The firm uses its resources to build and produce what the customer wants according to the customer’s preferred time frame and specifications. During this time delays or other obstacles might require changes to the original schedule, but the outcomes from this should be specified in the original order.

The next step is delivery. This is the stage at which the manufacturing firm distributes the finished product to the customer. If all has gone well and the order has been met, the customer takes possession of the final product, signalling that the firm has completed the order to their satisfaction. It is also possible that they reject the order and ask for changes or improvements, necessitating a return to the previous step.

Following the delivery, the firm generates an invoice for the services it performed and sends this invoice to the customer. The invoice is an acknowledgement that the firm and the customer agree that the firm has completed the order and a reminder to the client that they must pay for the product according to the order. The final price on the invoice will reflect the production cost of the item and the negotiated fee that the firm and the client agreed upon in the original order request.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][rev_slider_vc alias=”order-to-cash”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]The next step is payment. The customer pays the firm for the order. If the customer does not pay on time, this may include collections procedures, which can be internal or external. The firm chooses its own methods to pursue collection of the debt. This might include selling the debt to a collections agency and allowing them to proceed with the case.

The final step occurs after the firm has collected their payment, and it is the accounting step of recording the transaction in the firm’s books. This is the point at which the revenue of the order becomes an official part of the firm’s performance. The order to cash cycle ends at this point because it has run the entire length from order origination to booked cash, or income. The firm can now close the book on this order. It is likely that the firm has more than one active order at a time depending on its manufacturing capacity, staff, and specialization. The completion of one order frees up firm resources to move on to another, but the firm can, for example, begin the production step of a new order while pursuing collections on an old one without conflict.

Optimizing the order to cash cycle is key to achieving efficient use of firm resources. The company has limited production capacity and time, so it is important to make the most of those to maximize profits. For example, many firms conduct internal reviews to understand which steps in the order to cash cycle are acting as bottlenecks and slowing down the whole process or leaking too much cost. It might be the case, for example, that the firm’s system for processing orders is outdated and customer orders take too long between origination and when production begins. Or the firm might spend too much money on collections, so they could be better off outsourcing the task.

The bottom line is that a manufacturing firm that wants to succeed needs to continually monitor their order to cash cycle and be on the lookout for potential process improvement. This comes outside of any changes to marketing or improvements to its actual ability to manufacture, as this is purely a management issue. Employing the firm’s tools and resources efficiently is the best way to stay profitable in today’s competitive and globalized market. This is especially true in light of the continued rise of foreign competitors and the shift towards automation that make it harder to squeeze a margin out of any given order. A stronger order to cash cycle will not only increase profits but also improve the firm’s reputation by reducing how long customers need to wait for complete orders.[/vc_column_text][/vc_column][/vc_row]