As part of being a lean leader, a major portion of a manger’s job is to continuously examine every part of an organization’s operations to look for potential improvements.

Every process, each workflow and all projects should fall in line with the lean tenet of continuous improvement and should benefit the value stream.

But one process in particular is often overlooked when making these decisions to streamline. And what’s worse is that this end-to-end process touches almost every aspect of a company’s business.

You’ve probably heard of this process: it’s commonly known as Quote to Cash.

Defining Quote to Cash

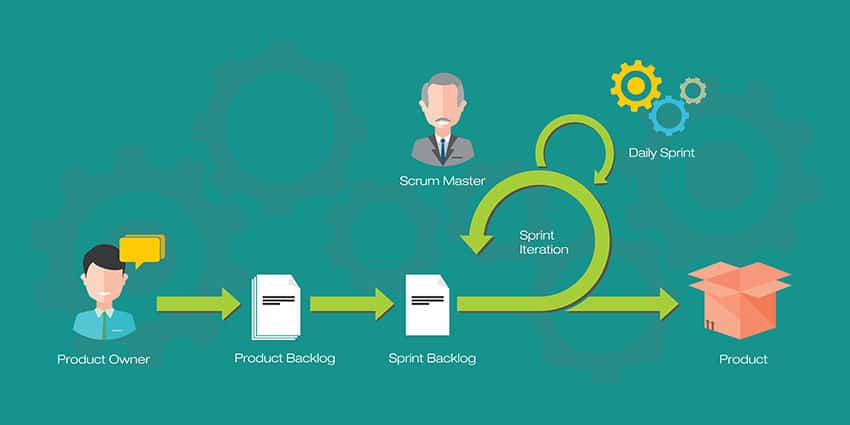

Quote to Cash, commonly abbreviated as Q2C or QTC, essentially covers all the processes on the selling side of your organization. It covers all the steps that fall between generating a quote for a customer all the way to collecting and managing revenue.

For a process that covers the entire sales lifecycle, it often doesn’t receive the attention it deserves. And its direct impact on sales and customer experience should dictate that this process should be a fine-tuned machine running as efficiently as possible. However, that usually isn’t the case.

Quote to Cash Issues

As organizations grow and scale up, it’s not uncommon for processes that were once simple to become disjointed. And once processes are in place, it’s always a bit of a challenge to go against the grain and change them (particularly if they are working, even if they aren’t working to to their full potential).

A disorganized or inefficient Q2C process presents a number of serious issues for businesses. When steps in this crucial process are disjointed, customers may be misquoted for services/products, contracts may be bungled, invoicing may be delayed and revenues can suffer as a direct result of these inefficiencies.

And as we previously mentioned, a Q2C process that isn’t optimized can also have a negative impact on the customer experience. When a customer has made the decision to purchase your product or service and encounters a disorganized payment process, they may think twice about their investment.

Streamlining for Efficiency

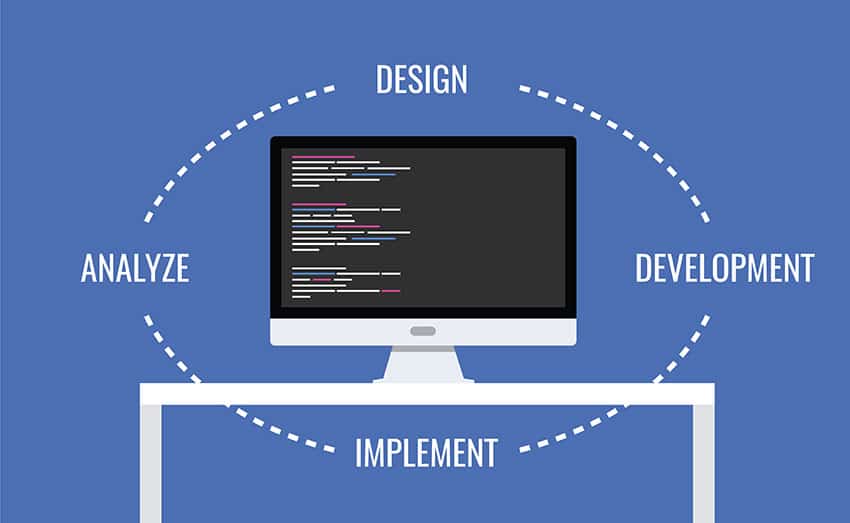

So how can this integral process be improved? For one, take a hard look at all the steps in place that span pricing/quote generation and negotiation, contracts, invoicing and the payment process. There’s likely room for improvement in the execution of any or all of these steps, even if it’s simply improving how these processes work in conjunction with one another.

Ask some tough questions. Are there guardrails in place to ensure sales people are providing customers with the correct prices? Are only approved discounts being offered? Are invoices being sent promptly and are accounts being reconciled?

Examine these workflows and consider investing in a system that automates at least some of these processes. Automating pricing, for example, can keep quotes more accurate and error-free compared to manually handling this function.